Setting the pace or keeping up — is your board future-fit?

In brief

Institutional investors are not a brake to corporate action on global challenges. They endorse the corporate investments needed to make progress on these issues and will increasingly factor the corporate response to global challenges into their investment decisions.

Board directors also support engagement—even more than investors.

Global CEOs see more growth opportunities than risks in acting on global challenges.

The next ten years will see significant advances in the public-private partnerships, reporting standards and cross-industry collaboration needed to address global challenges.

Discover six new or improved practices your board can adopt to become future-fit.

For marketing organizations, what it takes to succeed looks substantially different these days. This era of perpetual transformation requires agility and vision. Key challenges include steep customer expectations, the emergence of new marketing channels and abundant, ever-expanding data. As a result, the role of the chief marketing officer (CMO) is becoming more complex and strategic. Expectations such as driving efficiencies in cost and agility have never been higher. And the number of activities has never been greater. Central to all of it is the necessity to rethink the relationship with agencies and the organization at large.

This increase in responsibilities leaves many CMOs feeling overwhelmed. The challenges of the role grow exponentially if the organization’s operating model isn’t evolving or adapting to respond to the new demands of the business environment. How can CMOs succeed without the appropriate processes, capabilities, technology and talent? MarCaps, LLC, a marketing consultancy firm, polled marketing managers from 493 companies and found that only 20% of them are satisfied with the effectiveness of their departments.¹

There are several reasons why crafting the right operating model is now more critical than ever, including:

- CMOs have always had accountability for the brand. The challenge has been to deliver that brand promise across a customer journey owned by many other functions — from supply chain to customer care. Marketers have adapted as leaders and become strong integrators of experience across the organization.

- Technology is evolving fast, and the operating model needs to evolve with it so the organization can benefit from novel technological capabilities. Integrated and automated processes must be built (e.g., AI-generated marketing content), and technology roles that traditionally weren’t part of marketing are now integral to the function (e.g., data scientists, software engineers, and creative technologists).

- Consumers expect experiences to be relevant and contextual. Marketers must have the capability to deliver personalization at scale leveraging technology, such as customer relationship management (CRM). This will impact the operating model in different ways, from scaling the size of certain functions (e.g., creative and audience management) to automating processes.

- Creating centers of excellence to expand the impact of limited talent or embracing new partnering models to scale faster are two of the main strategies in the marketplace.

If architected correctly, the marketing operating model can help organizations adapt to market disrupters and serve as a competitive advantage. However, a poorly designed or misaligned model can have implications beyond marketing — it can impact an organization’s overall effectiveness and success.

The marketing function is at a crossroads where its role in the organization, the value it brings and how it operates must be redefined. CMOs need to transform their operating models to increase the impact on the organization, drive growth and win in the market. This article explores how we help CMOs approach the design of their operating model.

MKC has identified six key areas of action for boards to test their future fitness and, within each, highlighted questions your board should consider:

Gather new perspectives

#1

Revitalize board dynamics

#2

Increase focus on the long-term

#3

Adapt communication, protect reputation

#4

Align and monitor culture

#5

Enhance risk and compliance oversight

#6

1

Chapter 1

Action 1: Gather new perspectives

To receive the quality and breadth of insight needed in today’s environment, future-fit boards ask the right questions.

Gathering perspectives is not just about gaining a view, for example, on the quality of customer experience or an understanding of employee treatment, for the purposes of assessing past performance. For future-fit boards, gathering a broad set of perspectives is important at a strategic level.

Proactively gathering perspectives and seeking input from stakeholders, including investors, helps to inform decisions about strategic direction, emerging risks, purpose, values and long-term health of the business. What are you hearing about how your stakeholders view your strategic priorities? What are you hearing about their preferences in balancing short- and long-term objectives? What are you hearing about their values and core beliefs? How are their values and interests changing and what do these changes tell you about the opportunities and risks facing the business?

Future-fit boards help their stakeholders by asking the right questions and this, in turn, helps to create two-way dialogue that builds trust and maximizes access to talent, markets and customers.

Start by conducting an exercise, with periodic review, to map and prioritize stakeholders. There are methods for mapping stakeholders by influence and interest, or power and impact, and to identify groups with the most significant ‘stake’ in the business. It can be useful to ask: who would be impacted if our business disappeared tomorrow and who would start the business again because they see value in the purpose or contribution of the business to society? 5 This can prompt discussion about the effect of the business’ activities and its position in a wider network of interests and values.

Future-fit boards are also strategic in their analysis of feedback and all types of external information and data. While it’s possible to get overwhelmed by data, not all of which is necessarily important or relevant, future-fit boards take charge of getting the right information and developing their knowledge on the right issues.

They make use of a variety of sources, including new ones, such as social media, and ask for data on new types of metrics which might not have been gathered in the past, for example, on issues around culture, customer behaviors or technological disruptors impacting their industry.

“There are so many different types of investors and it’s important to be proactive in understanding what interests them and how they and other stakeholders are assessing your performance. Boards must guide their conversations with investors to focus on strategic issues and the metrics most reflective of long-term value.” Ken Williamson, Partner and EY UK Corporate Governance leader

Material stakeholders are different for every company. Future-fit boards are proactive, have a handle on their external landscape and bring that information to the board table for robust discussion around risks, opportunities and potential impacts on long-term purpose. They reimagine their ecosystem and reshape performance.

Founder and MKC Americas Corporate Governance leader

Questions for your board:

- Are we talking to the right stakeholders (both internal and external) and asking the right questions to get insight and input on strategic matters?

- Have we reviewed the types of information we receive and whether there are new data points we need to see?

- Are we making use of stakeholder perspectives, external data, and relevant expertise to educate ourselves on new areas of risk and opportunity and have the right conversations?

2

Chapter 2

Action 2: Revitalize board dynamics

Future-fit boards consider their composition in the context of long-term strategy and the need for challenge, reinvention and adaptation.

What will the boardroom of the future look like? Who do you need in the boardroom to optimize performance now and for years to come? Maintaining a diversity of background, experience and cognitive style is essential and requires planning to ensure a balance is maintained as new directors come and go.

For future-fit boards, it’s also about how new technologies and ways of working add a new dimension to the diversity discussion. Future-fit boards dig deeper to ask: What does under-representation of women in technology mean for your board and your business? What biases could lurk within algorithms providing information to the board? 6

Even with a well-balanced and diverse board, it’s possible to squash input and underutilize your assets. Future-fit boards actively value varied input, differences of opinion and disruptive ideas.

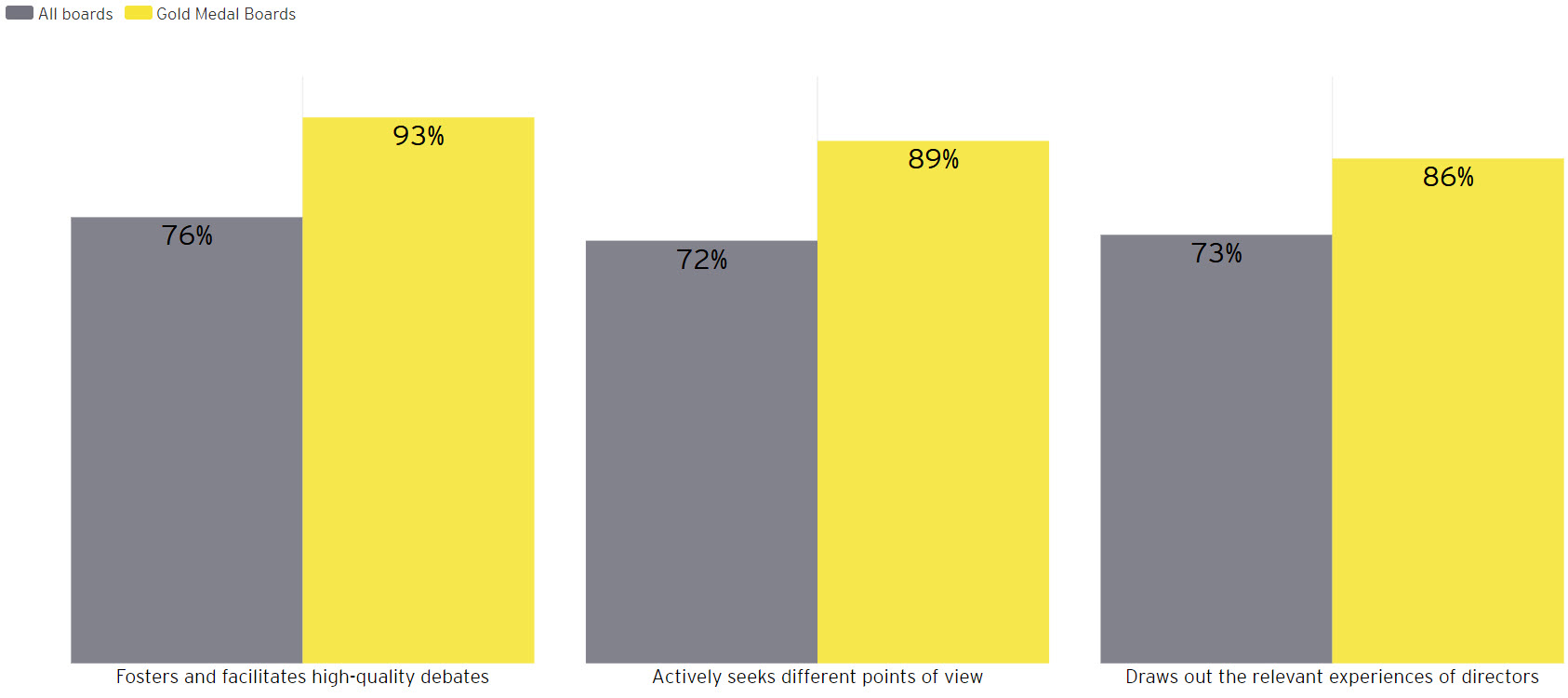

In one recent study, ‘Gold Medal Boards’ that rated themselves as highly effective and oversaw a high-performing company (based on outperformance on total shareholder return), more frequently reported having a Chair who drew out relevant experiences of directors, actively sought different points of view and fostered and facilitated high-quality debates. 7

In a rapidly changing world, future-fit boards recognize the value of diversity in age – valuing newer directors while also leaning on experience. And working as a whole, they act as learning boards.

Rather than rely on the expertise of one director with a relevant skillset, they train and re-train for the board as a whole to have the right level of knowledge to make informed decisions and provide transformative leadership. Is there an area of the business, an industry trend, a new technology or an emerging geopolitical risk that your board would like to better understand? Draw on internal knowledge, bring in external experts, identify resources and share experiences.

Ongoing self-reflection is another hallmark of future-fit boards, with and without the help of external facilitation. What are the elephants in the room? How effective is your communication, agenda management, decision-making, leadership and oversight? Consider how market shifts and industry dynamics impact time commitment, information access requirements and relationships with management. 8 Review, reinvent, take bold action and unlock new value.

Questions for your board:

- Do we seek and encourage the provocative and the unexpected?

- Are we reaching outside of our traditional capabilities to analyze business challenges and issues from every angle?

- How open are we to reinvention, adaptation and transformation within the boardroom?

3

Chapter 3

Action 3: Increase focus on the long-term

Future fitness is about unlocking new value and future-proofing your business.

Pressure on the short-term remains high amongst some investors, and with increased disruption and uncertainty, it’s easy to understand why some boards would be focused on quarter to quarter survival.

As EY and the Coalition for Inclusive Capitalism remarked in a recent report on measuring the drivers of long-term value, ‘the best businesses are defined by more than their short-term profitability. They drive broad-based prosperity by creating value for shareholders, customers, employees, and society alike.’ 9

Long-term strategies are important as a stake in the ground but must also be adaptable based on new intelligence, technologies and industry developments. Beyond technological developments, disruption can come from regulation, consumer behaviors, sector convergence, employment patterns, societal expectations, geopolitics, climate events and more.10

Future-fit boards are focused on identifying megatrends and guiding management to face new challenges and innovate to seize the upside of disruption.

Future-fitness is also about creating an environment for management which provides flexibility to develop better, more innovative business models, new collaborations and new ways of working, drawing on talent and incubating new ideas.

A recent EY study of 500 US executives found that 42% of executives cite limited budget as their biggest barrier to activation on innovation initiatives. 11

Using intelligence gathered from stakeholders is important for shaping long-term value. For example, boards can sometimes make assumptions about what investors and stakeholders are interested in; what they value and support. Based on another recent EY survey, 42% of global board members felt that investors would support long-term investments that improve long-term business prospects even if they diminished near-term financial performance.

The same survey revealed that in fact 60% of investor respondents agreed that they would support this type of long-term decision-making. 12 Customer insights on their needs and problems are also a vital source of information.

Future-fit boards are focused on clearly articulating their long-term strategies. What investments are they making to protect and sustain the value drivers underpinning the business? With no universally applied and disclosed metrics on value drivers from human capital, innovation, culture, customer loyalty and trust, it can be a challenge to communicate with investors on a consistent basis.

However, in today’s market, intangible assets make up over 50% of a company’s market value on average – up to 80% in certain industries - and information about how these assets are protected is of increasing interest to investors and other stakeholders. 13 “There can be a disconnect between boards and investors, but future-fit boards communicate long-term value, build trust and inspire a new vision for growth and transformation.” Rohan Connors, EY Australia People Advisory Services

The Embankment Project for Inclusive Capitalism (EPIC) brought together companies, asset managers and asset owners in an effort to help businesses communicate how they are creating long-term value to markets and the resulting report identifies metrics for key drivers of long-term value. It also outlines the Long-Term Value Framework which is a helpful tool for boards to consider. 14

We are in an age of superfluid markets and industry convergence. New markets are being created as industry lines are blurred and ‘social media companies are becoming live entertainment broadcasters, traditional car manufacturers are transforming into on-demand service companies and telecom companies are leveraging huge consumer bases, capital and data, to disrupt the banking sector’. 15

Future-fit boards are focused on transformation and adaptation for the long-term. They are informed by megatrends and stakeholder intelligence and they clearly articulate their long-term strategies and their vision for growth. Future-fit boards reinvent a future fit for a better tomorrow.

Founder and MKC Americas Corporate Governance leader

Questions for your board:

- How ready are we to articulate our long-term value-creation narrative?

- Are we enabling management to experiment, make bets and reimagine growth outside of our traditional capabilities?

- Is our long-term strategy sufficiently adaptable and informed by latest information, megatrends and stakeholder insights in a rapidly changing world?

4

Chapter 4

Action 4: Adapt communication, protect reputation

Reputation in an increasingly transparent world can be an important as well as a fragile asset.

76%

of respondents think CEOS should take the lead on change rather than waiting for the government to impose it. (Source: Edelman Trust Barometer 2019)

Questions for your board:

- How accurate is public understanding about what our business does and how we contribute to society and the economy?

- Are we constraining management from helping to solve global challenges and engaging with employees and other stakeholders on issues that matter to them?

- How ready are we to respond in the face of a crisis and how assured do we feel that our purpose is being lived and we can always stand by our values?

5

Chapter 5

Action 5: Align and monitor culture

Emerging technologies are changing the workplace and having an impact on culture.

1

- Are we talking to the right stakeholders (both internal and external) and asking the right questions to get insight and input on strategic matters?

- Have we reviewed the types of information we receive and whether there are new data points we need to see?

- Are we making use of stakeholder perspectives, external data, and relevant expertise to educate ourselves on new areas of risk and opportunity and have the right conversations?

This increase in responsibilities leaves many CMOs feeling overwhelmed. The challenges of the role grow exponentially if the organization’s operating model isn’t evolving or adapting to respond to the new demands of the business environment. How can CMOs succeed without the appropriate processes, capabilities, technology and talent? MarCaps, LLC, a marketing consultancy firm, polled marketing managers from 493 companies and found that only 20% of them are satisfied with the effectiveness of their departments. 1

References

-

Innosight,

Corporate Longevity Forecast: Creative Destruction is Accelerating

, 2018.

-

Harvard Business Review,

How Winning Organizations Last 100 Years

, September 2018.

-

EY,

How Can Purpose Reveal a Path Through Disruption? (pdf)

, 2017.

-

Harvard Business Review,

How Winning Organizations Last 100 Years

, September 2018.

-

EY,

Politics, populism and trust in business: discussions for the boardroom

, November 2017.

-

EY,

How Winning Organizations Last 100 Years

, March 2019.

-

Harvard Business Review,

Going for Gold: Global Board Culture and Director Behaviors Survey

, April 2019.

-

EY,

Future-proofing corporate governance (pdf)

, June 2017.

-

EY and the Coalition for Inclusive Capitalism,

Embankment Project for Inclusive Capitalis. (pdf)

, 2018.

Summary

6

Chapter 6

Action 6: Enhance risk and compliance oversight

Future-fit boards embrace risk and seize the upside.

Partner and Risk Advisory practice leader

Questions for your board:

- Are we combining rich data and smart technology to power our risk and compliance oversight?

- What new skills and competencies are needed at board and management level to make the most of ‘Finance 4.0’ information?

- Is the board treating data as a strategic asset and are data governance risks encompassed in the boards risk assessments?

Related articles

Contact us